To help businesses succeed in the New Normal, we are dedicating this webpage through tips on how MSMEs can manage using MBA principles.

CH 1 : How my sanity survived the New Normal? – 2021

I am revitalizing my 2020 article into a video.

Below is my article in 2020:

CH 1 : How my sanity survived the New Normal? – 2020

Before the ECQ I have some routine breaks that revitalized me, like early morning walks in the beautiful campus of the Ateneo (felt like Baguio even in summer), weekend beer with friends and office mates, church community activities and a sideline business that quenches my thirst to share. My routine breaks are nature and community, then came the Covid-19 pandemic where I was forced to stay home for months and close my sideline business. I was privileged that even during the ECQ I was still able to work from home and have a family to take care of as a routine. I could not imagine the otherwise of being alone and doing nothing. Having got used with routine breaks, I tried new activities such as gardening, delivery disinfection, home repairs and insect extermination. I also kept myself updated with news and pretended to be a back-seat IATF, but my sanity was still breaking while trying to be normal in the New Normal. The intensity increased when it became clear that the New Normal will last for around two years. I felt like the boy in the video, I was becoming grey.

After a few weeks, I shifted my mindset from being inward to outward focused, my thirst to share was awoken once more. It started with a free webinar on how to manage your business on the Post-ECQ using the knowledge I have gained as a back-seat IATF and hours of reading on the internet. The message was simple, to survive in the Post-ECQ MSMEs needs to go digital and Reset-Realign-Restart(a). To Reset, I re-assessed my SWOT(b), Strengths and Weaknesses during the ECQ and looked at the Opportunities and Threats then started strategizing for the New Normal. I saw that my Strengths matches with the Threat the MSMEs will face on how to operate in the New Normal and made this as an Opportunity to help MSMEs succeed in the New Normal. This will be my re-mission, a rehashed mission to re-focus to support MSMEs. I took the SMEpinoy.com brand out of the “baul”, and planned to use this as a vehicle for my re-mission. I created a BHAG and created an initial plan using the Business Model Canvass(c) framework. To Realign, I fired up again my sleeping partners in Servus and asked for a re-commitment, to continue working with those who are still willing. To get new blood, instead of finding partners or start a new company, which is unwise knowing how hard it is to close a corporation, I instead looked for new alliances with existing businesses. People who like me are just waiting for the starting gun of the lifting of the ECQ and start sprinting to do business in the new Normal.

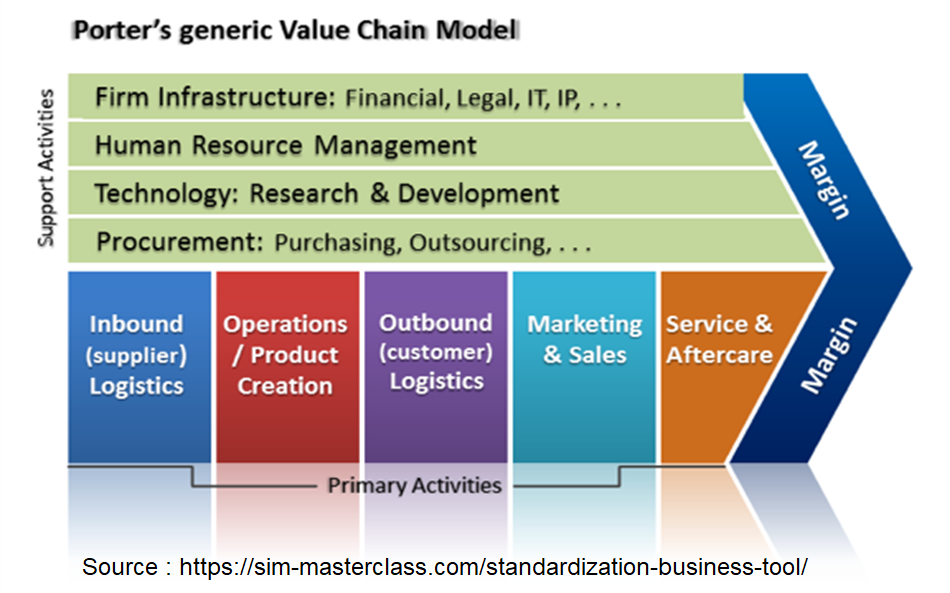

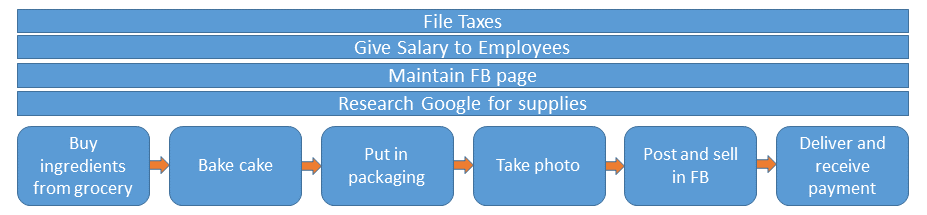

But this was not the case, we were just brought down from ECQ to GCQ and still finding it hard to Restart. More businesses are forced to close or slow down which cause a lot of people to lose their job. Digital Commerce was booming even though the government said they will tax them. DTI said the online sellers should register their business so the online buyers can run after suppliers of defective product. I see the value of DTI’s reminder to protect the online buyers, but I also see the risks of registering your business. A business is not simply finding a product or service, branding it and selling it. The department you see at large corporations, HR, Operations, Finance, etc. must be present in any business big or micro. Although for big businesses it can be a division for a micro enterprise it will just be a function done by the sole owner of the business. Not doing this other functions is one of the major reasons why less than 0.7% of businesses in the Philippines survive more than 5 years, it is even much less during the Covid-19 pandemic. As it is hard to register a new business, it is much harder to close a business. During the GCQ, I am receiving at least five FB page group invites a day for new online businesses. Based on the statistics, from the 25 new FB page invites I receive per week only 1 or 2 will still be there 5 years from now.

Thus, I saw a new segment of society that needs the support of my MBA and more than 23 years of experience as an Entrepreneur, people who lost their old source of income and trying a new one. I took out again my trustee Business Model Canvass Template to create SMEpinoy Business Sanctuary whose mission is to guide startups from the dream stage to the expansion stage. The GCQ, as a blessing in disguise has given me time to Realign before Restarting a better planned and equipped SMEpinoy.com.

To answer the question, SMEpinoy.com and the weekly “e-numan” is how my sanity is surviving in the New Normal.

References:

- Reset-realign-restart : https://www2.deloitte.com/us/en/insights/economy/covid-19/guide-to-organizational-recovery-for-senior-executives-heart-of-resilient-leadership.html

- SWOT Analysis : https://en.wikipedia.org/wiki/SWOT_analysis

- Business Model Canvass : https://en.wikipedia.org/wiki/Business_Model_Canvas